By Niket Nishant

Dec 10 (Reuters) – Emerging market assets inched higher ahead of a widely expected interest rate cut by the Federal Reserve on Wednesday, while investors also monitored developments in Ukraine that could influence global risk sentiment.

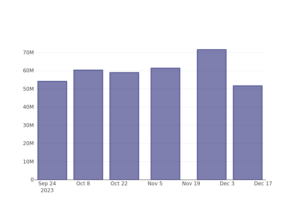

MSCI’s gauge of emerging market stocks rose 0.33% and the currencies index edged 0.1% higher, stabilizing after a drop in the previous session.

The moves reflect a tone of cautious optimism as jittery investors await Fed Chair Jerome Powell’s comments on the outlook for rate cuts in 2026.

With much of the enthusiasm around Wednesday’s likely cut already priced in, markets are now waiting for the next catalyst, and any hawkish commentary from Powell could prompt a reassessment of risk.

“It could be hard to find anything dovish in today’s Fed communication,” wrote Chris Turner, global head of markets at ING, adding that expectations of two more cuts next year could be on thin ice.

Attention is also focused on Ukraine, where President Volodymyr Zelenskiy is preparing to present the U.S. with a new proposal to end the war with Russia. A breakthrough could lift a major overhang on global stocks.

The country secured support from creditors for its plan to swap $2.6 billion of growth-linked warrants for a new class of bonds, ending a longstanding stalemate.

The price of the warrants jumped 0.7 cents, scaling a fresh four-year high, according to Tradeweb data.

POLITICS, DATA DRIVE TONE

In Europe, investors continued to monitor a mix of economic and political factors.

The Hungarian forint was 0.4% weaker against the euro. Prime Minister Viktor Orban and U.S. President Donald Trump did not agree on a proposed $20 billion financial lifeline but committed to start talks on a new form of financial cooperation, Hungary’s foreign minister said on Tuesday.

Czech equities were little changed after climbing to a record high on Tuesday, when President Petr Pavel appointed the billionaire leader of the populist ANO party, Andrej Babis, as prime minister.

Data released on Wednesday showed Czech consumer prices rose 2.1% year-over-year in November, a slower pace than the previous month. Central bankers have flagged lingering inflation risks and urged caution over cutting rates.

In China, real estate shares jumped 5.9%. Figures on Wednesday showed annual consumer inflation accelerated to a 21-month high in November, but domestic demand in the world’s second-biggest economy remains weak, prompting calls for further policy support.

The ailing property sector is seen as a potential beneficiary of any additional measures from Beijing.

Elsewhere, a board member of South Korea’s central bank said foreign exchange authorities need to take action to curb the South Korean won’s decline against the dollar. The currency was little changed.

Indonesian stocks rose 0.2%, while the rupiah eased 0.1%. A representative of the country’s coordinating ministry for economic affairs told Reuters that tariff negotiations with the U.S. were still ongoing, after a U.S. official said the trade agreement reached in July was at risk of collapsing.

(Reporting by Niket Nishant in Bengaluru; Editing by Alexandra Hudson)